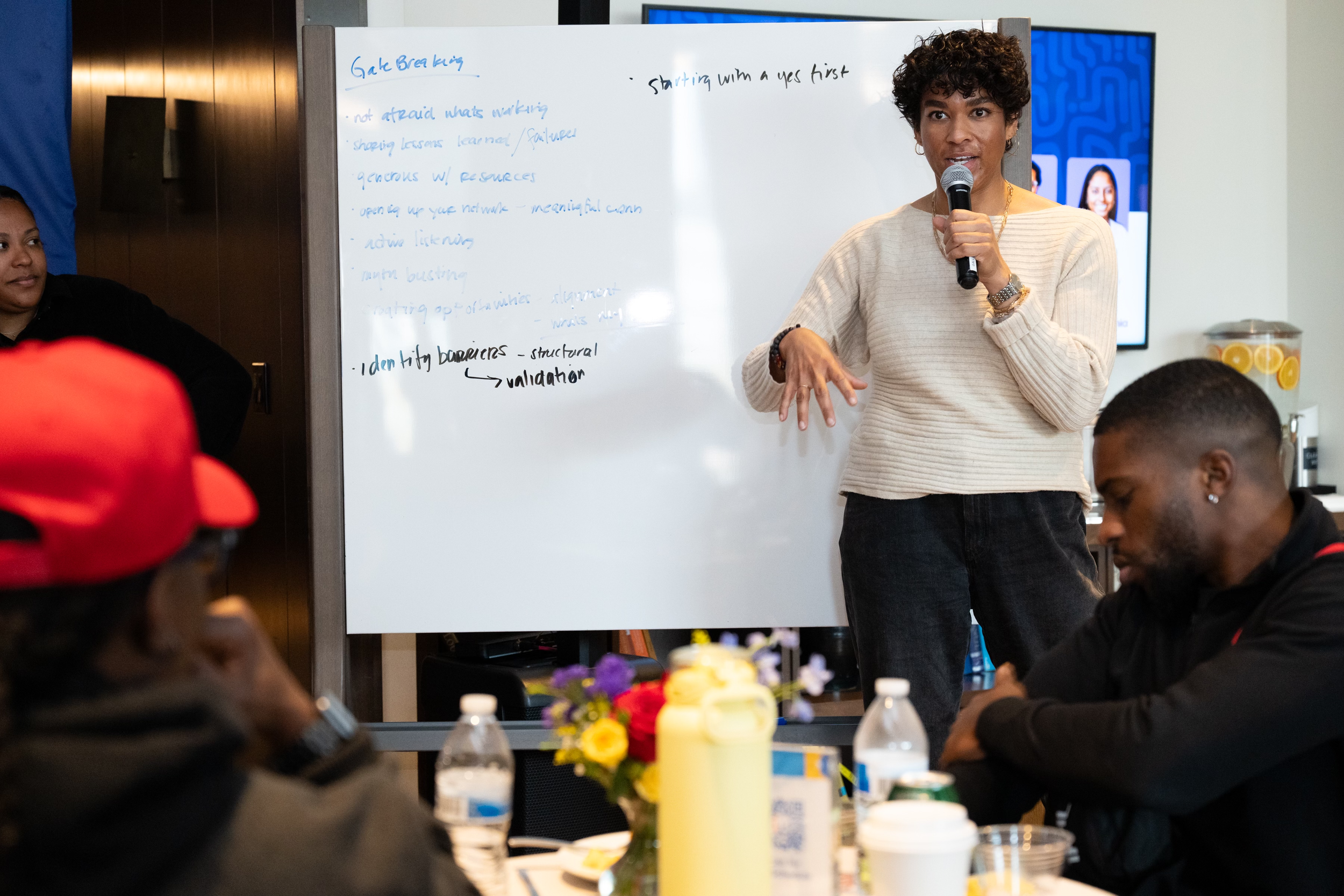

Workshop Facilitation and Keynotes

Creating and holding safe, approachable space for ideas to transfer, relationships to deepen, and for individuals to feel seen and heard.

Impact Investing

In-person or Virtual

60-90 minutes

Impact investing is often defined through corporate or multi-generational family office frameworks—but what shifts when we define impact through our own communities?

This session invites a reimagining of what it means to invest with purpose. Through grounding, journaling, and dialogue, we explore how inherited systems of philanthropy, endowments, and government grants have been shaped by fear, control, and scarcity—and how we can move beyond them.

Together, we’ll examine what “impact” means to you and uncover approaches that prioritize knowledge, collective care, and long-term sustainability. Participants leave with practical language for navigating impact conversations, a stronger sense of agency, and tools to align investments with community values and wealth-building goals.

In-person or Virtual

120 minutes

Your Unique Value

In this session, we map your unique value across practice, power, and community—the three pillars you use to anchor meaningful work.

Blending reflection prompts, light strategy, and exercises from Thought Leadership Lab with quotes and grounding from bell hooks, we translate lived experience into a crisp, usable value statement and proof points.

Participants leave with language that feels true (not buzzwordy), a simple storyline you can reuse in bios and pitches, and next steps to activate it—on LinkedIn, in decks, and in conversations with partners, clients, or investors.

Venture Capital 101

In-person or Virtual

60-90 minutes

Venture capital has long been shrouded in mystery—an intentionally gatekept system designed to feel inaccessible.

In this session, we pull work to demistify venture capital, as its very uncomplicated. We’ll cover the flow of capital, fund structures, who makes decisions, and how power circulates through the ecosystem. We’ll examine the cultural myths that have made investing feel exclusive and reframe VC as a tool for creativity, community, and collective liberation.

Participants leave with language and confidence to enter VC spaces, ask sharper questions, and reimagine investing as an act of alignment and possibility rather than exclusion or control.

Employee Resource Groups

In-person or Virtual

90-120 minutes

Although corporations may be getting rid of most DEI language, Employee Resource Groups still exist, and they have budget.

Those yearly budgets usually DO NOT roll over, so take advantage.

My work with Employee Resource groups can be customized to be either a combination of any of the above, or something completely different.

Whether you’re looking to engage your ERG with a meaningful team building session, or create better structure for the group, we’ve done it all.

The ability to have culturally relevant sessions while at work is like a mini-retreat for your team to come together in a safe space.